Growing the Good, One Micro-Loan at a Time

Published: April 15, 2020 / Author: Amanda N. Jacobson

Imagine you are the average resident of St. Joseph County.

Your annual per capita income is $27,338, you are among the 88 percent of residents without a college degree, and your monthly rental payment is about $770.

Now imagine you are experiencing an unforeseen blow to your income: a reduction in working hours, a health crisis, an expensive emergency vehicle repair. You only need a few hundred dollars to meet this unexpected need, and a traditional bank loan is not an option.

A payday lender seems like your only alternative for quick cash; however, the interest rate to pay it back can be as high as 72 percent, depending on your credit history.

This intersection between dire financial need and narrow alternatives to lending is where Notre Dame alumnus Peter Woo (B.B.A. ’14) found his purpose. As a sophomore in the Mendoza College of Business, he dove headfirst into researching the predatory lending landscape in South Bend.

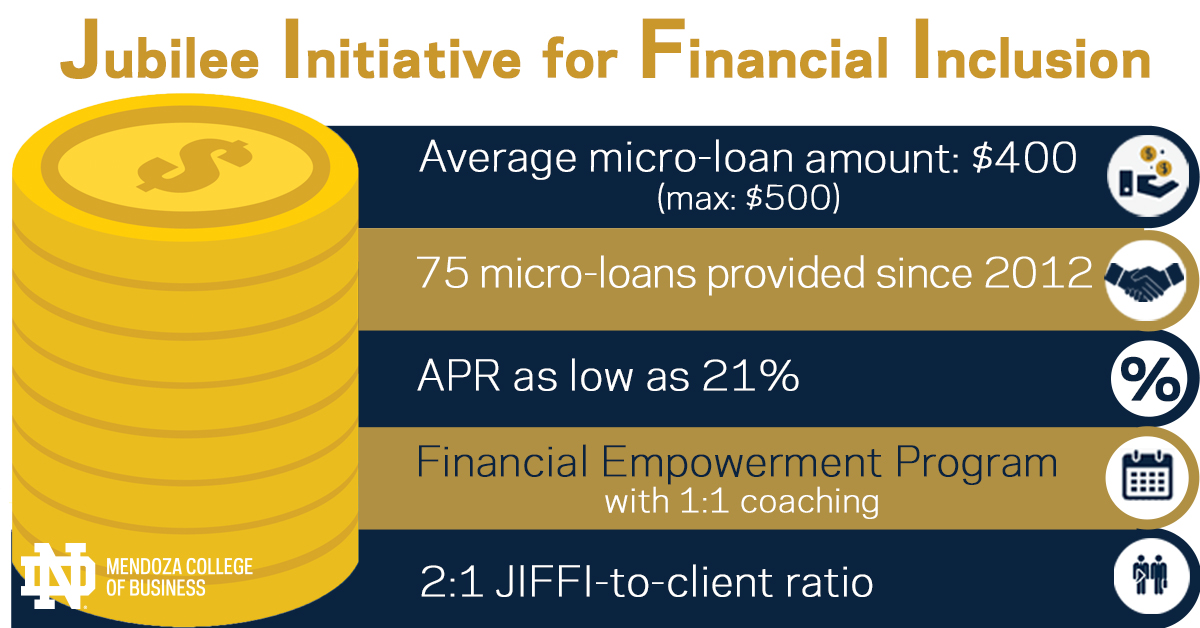

What he learned motivated him and seven peers to form the Jubilee Initiative for Financial Inclusion (JIFFI) – a now eight-year-old nonprofit micro-lender providing a more personalized, ethical approach to small loan-making.

As of 2019, there were 11 payday lending companies operating in St. Joseph County, many with multiple storefront locations. Today, JIFFI stands as the sole nonprofit micro-lender in the city of South Bend.

We recently sat down with three of JIFFI’s student leaders to learn about what sets JIFFI apart from other lenders in St. Joseph County, as well as how the organization works to grow the good in business throughout South Bend.

Sam Cannova is Chief Operations Officer for JIFFI and a junior in the program of liberal studies, with minors in business economics and philosophy, politics and economics (PPE).

Grace Condon is Vice President of Business Development for JIFFI and a sophomore with a double major in international economics and global affairs, with a concentration in Chinese language and culture.

Emily Pohl is Chief Executive Officer for JIFFI and a senior studying international economics, with a minor in international development studies.

Can you give me a quick rundown of JIFFI, its mission, and its vision as an organization?

Cannova: Our official buzzwords are “a 501(c)(3) nonprofit run by students to serve as a micro-lender in the community,” but what that means to us is bringing financial empowerment to economically disadvantaged neighbors in South Bend.

Often that comes through in one of our two primary functions: the first is short-term micro-loans with very low interest rate. Say, your car breaks down and you need it to get to work and losing your job is a non-option. Usually our clients would have to go to a payday lender with exorbitantly high interest rates … rates that sort of just keep you chained to the loan, so you’re just paying off interest month by month. That’s where JIFFI steps in, offering a much more personal connection but also much lower interest rates to make paying off the loan more feasible to get back on your feet.

How many community members does JIFFI serve annually, on average?

Cannova: Since our start in 2011, we’ve disbursed about 75 loans. And we serve somewhere between 10-15 clients per year.

And what is the average micro-loan amount JIFFI provides?

Cannova: It’s about $400 if we were to draw an average. We’re capped at $500 due to Indiana laws around micro-lending.

Pohl: And we’re capped at 25 loans a year right now, because we don’t yet have an Indiana lending license.

What are some of the reasons someone might seek out help from JIFFI?

Cannova: The typical reason is loss of income. But sometimes, our clients just need a little bit of a boost to get something that would be a huge benefit. Once case could be if you could purchase a car, that might allow you to drive further to look for work with higher wages. Another much more personal case is we’ve worked with some clients who were looking to get into new housing – they might have been in an abusive relationship and an extra $500 would be enough for a security deposit on a new apartment.

Condon: I also find it interesting when we help clients get out of payday loans they’re currently in. That really aligns with our mission to be able to get them out of that negative spiral and into a much more steady debt.

Pohl: We’ve had a few clients come to us so they could get Christmas presents for their kids. They know they’re going to be paid on a certain date, they just kind of need that money right now. I think it’s sometimes the things we take for granted, that some people need a short-term amount of cash in order to do themselves.

How is JIFFI different from a typical payday lender?

Cannova: Quantitatively, our loans have a much lower APR – about 21 percent – whereas most other payday lenders’ rates can reach about 360 percent. That’s close to the cap in Indiana.

Qualitatively, we do our work with more personal attention and a much more adaptable approach. We typically assign two JIFFI student members to each client – that becomes their client pair – the client’s main points of contact. We’re adaptable in the sense that, from that relationship we hope an open chain of communication grows.

So then, if a client say, runs into another problem or their paycheck is a little short – they weren’t able to get as many hours one week – but they have a payment coming up, then they can shoot us a call and we’ll be flexible, work around that, and adapt their fee schedule to make the loan more feasible to pay off in the long-term.

Condon: Also, something we’ve been doing this year is if the loan is paid off on time, or if the client continues communication and follows their restructuring, we’ve been giving their interest payments back as a rebate. It’s our way of showing that we don’t want to make money off of these clients, even though the money we make is very small already. We’re not in the business of profiting off these loans, but truly making sure our clients can repay them.

Pohl: And that builds in an incentive mechanism, too. If you make each installment on time, you get the full rebate of your interest paid, versus if you’re a little bit late on one payment and there is a valid reason, we would give a partial rebate of the interest. It’s nice to have that incentive.

Once again, our goal is to never have to see our clients go into default or have a client not be able to repay at all, so we’re willing to work with their schedules. For instance, with the COVID-19 outbreak, people are potentially losing their jobs. We’ve reached out to all clients who have ongoing payments and asked them if they wanted to suspend their payments for a term without added fees. So once again the priority is always on the client and their situation.

Speaking of the current crisis, have you seen any uptick in the number of people who are reaching out to JIFFI at this time, with so many losing their jobs or experiencing reduced hours right now?

Pohl: We went back and forth on whether we’d be able to give out loans at this time, but once the state passed the regulation of not going anywhere, except for essential business, we decided to suspend our loan-giving for right now. But, that being said, we recognize it could be a huge need right now.

So Sam and I met to talk about digitizing our loan process. Previously, something that’s been so important to us is meeting with the client, building up that personal relationship. Being face-to-face helps that so much, as well as the logistics of dealing with documents, but we’re working on digitizing some of the process so we can still be an option during times like this.

You mentioned JIFFI offers a Financial Empowerment Program – can you tell me more about that?

Cannova: The FEP is one of our divisions within JIFFI. It has about five students, and their main goal is to teach classes in the community about financial empowerment. It’s broken up into a few modules. Very typically, the program is retrofitted and structured around what the clients actually need. We’ve held classes at the YWCA, for example. So we go and do one class a week for about six weeks, with topics ranging from goal-setting and budgeting to managing your credit statements to organizing your bills, increasing income, sustainable saving habits and budgeting your expenses.

Pohl: We try to make [FEP classes] as personalized as possible. Something we do at the beginning of classes is the FEP leader will ask what the clients want to focus on, versus things that the clients already have a good grasp on. We are always sending clients the full program modules in case they want to reference anything. What’s most important is there is a set dynamic of us, students, meeting with people who in many ways have a lot more life experience, so we really want to be there to add to what they may not already know.

What does “growing the good in business” mean to you? How do you feel JIFFI exemplifies that mission?

Pohl: Something that’s always really attracted me to microfinance is instead of just providing someone a sum of money, it empowers people to shape their own futures and learn tools while they’re essentially repaying their loans and investing in something that will help them get back on their feet. I think it’s really cool to think about how we can take the skills we’re learning in class and apply them to something in the real world that’s socially oriented. JIFFI has been an awesome opportunity for us to integrate ourselves into the community – with both our community partners and with our clients – to gain a new perspective on issues that we would normally only read about in our textbooks. Seeing human faces and realizing how money can impact people positively and negatively is something very valuable.

Condon: I’ve found that being in JIFFI helps me understand all the business concepts I’m learning in class – loans, profit, fundraising – all those business skills, really. But JIFFI allows us to put all of that in a setting where we can see the impact on people and how we can contribute to something really positive. It has been a really good experience.

Cannova: In terms of cultivating the good in business, it’s that compassion and trust that doesn’t show up on a bank statement that JIFFI does rely on when we are making our loans, meeting our clients and developing relationships. We’re seeing business in a much more three-dimensional light that goes beyond the paper.

What advice would you give to other Notre Dame students with a passion for giving back or starting their own nonprofits?

Pohl: One very basic piece of advice is if you have an interest in something, or if something in class piques your interest, just start asking questions about it. Not just in class, but look for experts on the topic and do your own research to see what’s to be explored further. Think around a problem, choose it and see if you can design around it and innovate and shape a solution.

Condon: Notre Dame is a unique place in that it has an emphasis on growing the good and doing good in your future career. There are a lot of courses that intersect business with theology and philosophy. There are a lot of courses that help you consider not only the skills of your major but also what those skills look like in the real world. So I would suggest taking those classes and seeing the technical skills you’re learning in a different perspective.

Cannova: The one thing I’ve taken with me is to lead by listening first. As we’re adapting and improving our client process, countless times we’ve had to realize that something so easy for us may not be so easy for the client. Like when we say, “Why couldn’t we just request repayments with Venmo?” Well, maybe the client doesn’t have Venmo, or maybe they don’t have a bank account and they purely operate with cash. So, as with any sort of nonprofit work, leading by listening, fitting your work to the community, is the best way to reach the people you really want to serve.