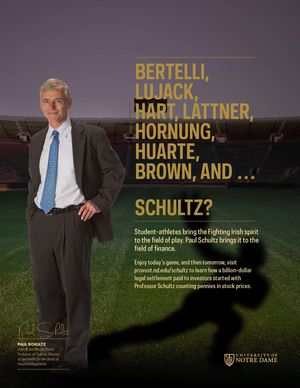

Paul Schultz brings the Fighting Irish spirit to the field of finance

Published: October 12, 2015 / Author: Office of the Provost

Paul Schultz: John W. and Maude Clarke Professor of Finance, Director of the Center for the Study of Financial Regulation

Early in my career, I learned firsthand the impact academic research can have on real-world practice. I was an assistant professor at Ohio State University and with my friend Bill Christie of Vanderbilt, published a paper asking “Why do NASDAQ Market Makers Avoid Odd-Eighth Quotes?”

Our research didn’t propose a new theory or employ advanced econometric techniques. Rather, it simply pored over mountains of stock quotes from Nasdaq dealers. These “market makers” provide liquidity for investors by standing ready to buy and sell stocks and, in return, make money by selling at marginally higher prices than they buy. But back in the early ’90s, something strange was going on: For many of the most active stocks, dealers were not quoting prices ending in odd eighths of a dollar (i.e., $.125, $.375, $.625, and $.875).

Why was that significant? At the time, stocks were quoted and traded in eighths of a dollar, or increments of 12.5 cents. By not using the odd eighths and only quoting stock prices in even eighths ($.00, $0.25, $0.50, and $0.75), the dealers guaranteed they would always make at least 25 cents on every share they bought and sold on behalf of investors—or double the 12.5 cents they would have gotten otherwise.

We identified this as “implicit” collusion among Nasdaq market makers; however, the ensuing investigation of these dealers by the U.S. Department of Justice suggested their actions were in fact well-coordinated, and the civil lawsuits filed against them were ultimately settled for just over a billion dollars (the dealers never admitted any wrongdoing). Beyond sparking the investigation that helped investors win this large settlement, our work also led to an eventual reorganization of the rules of the Nasdaq market.

While the immense repercussions associated with this paper are admittedly atypical, opportunities for faculty and industry professionals to learn from one another shouldn’t be.

As director of the Center for the Study of Financial Regulation in Notre Dame’s Mendoza College of Business, I am charged with leading our efforts to promote sound economic analysis of current and proposed financial regulation. We do this by bringing regulators together with academics so that regulators can learn about current academic research, and academics can learn about the current issues faced by regulators.

I like to think our center advances the broader aims of business education and research at Notre Dame, where we recognize business as a calling that can give dignity to employees and customers while providing for the material wellbeing of society.

Related Stories